If you read my bio, then you already know that I was a healthcare provider before I decided to jump into the world of commercial real estate. I worked at the Hospital of the University of Pennsylvania (HUP) for more than 6 years as a critical care nurse.

In an attempt to further my career, I began seeking various healthcare-related employment opportunities, such as advanced practice nursing, hospital management, and even medical school. After tons of research, I realized that none of those options were for me. However, I did notice that the University of Pennsylvania Healthcare System was acquiring and developing more than a dozen healthcare facilities within the tri-state area. For example, recently Penn Medicine began constructing a 17-story, $1.5 billion medical center that contains 500 beds located directly across their current 700-bed flagship hospital.

I also noticed that the hospital next door, Children's Hospital of Philadelphia (CHOP), recently completed phase 1 of a mixed-used research, life science, and medical office development project along the Schuylkill River. CHOP’s brand new Roberts Center for Pediatric Research is a 21-story, $275 million building, comprised of 466,000 square feet of research and office space, and is the first of a 2 million square feet four-tower campus.

As a front-line healthcare provider, I realized there were several large-scale trends that would provide growth within the healthcare real estate industry. So now, I will give you a quick primer as to why healthcare real estate is positioned for exponential growth for years to come.

Demand for Healthcare: According to the US Congressional Budget Office, "national healthcare spending is projected to increase from 16% of the GDP in 2013 to 25% by 2040".

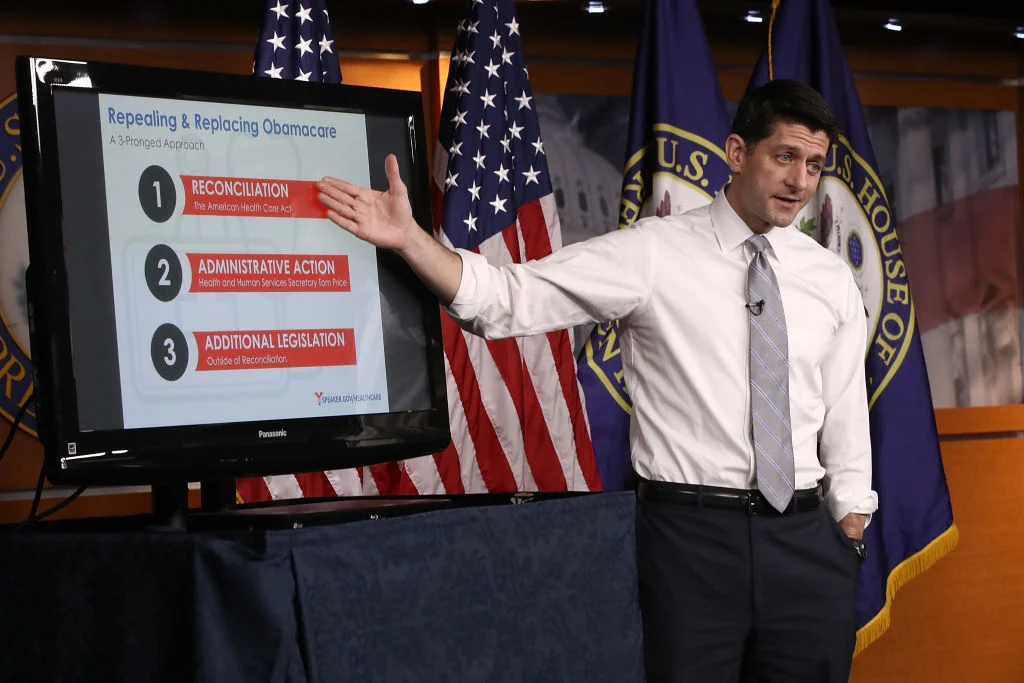

Delivery of Care: New developments in healthcare technology and healthcare policy is changing the way healthcare systems and physician groups deliver care to patients. Historically, healthcare providers and hospitals have been paid based on the volume of care they provide, but with the Affordable Care Act, this system is rapidly changing. Payment incentives are moving away from a volume basis towards a greater focus on the value of services and health outcomes. In an attempt to increase efficiency and decrease exposure to reimbursements healthcare providers are treating more of their clientele in outpatient facilities rather than in hospitals. According to the American Hospital Association, "outpatient surgeries have increased more than 30% over the past two decades".

Demographic shift: The U.S. senior citizen population is steadily getting older and living longer. As a result, there is increasing demand for real estate required to house and care for our aging population. According to the U.S. Census Bureau, "the seniors' population will more than double between 2015 and 2060". Furthermore, new supply of healthcare real estate is not keeping pace with expected demand. This phenomenon is known as the "Silver Tsunami", although the term may be a little dramatic, it projects the notion that there are many opportunities for healthcare-focused real estate developers, brokers, REITs and institutional investors.

Durable Asset Class: While many real estate sectors are impacted by macroeconomic events healthcare real estate is a need-based property type, which is typically insulated from economic drivers. GlobeSt.com did a recent interview with Evan Kovac of HFF's Healthcare Capital Markets Group and he stated "Investors see medical office properties as a stable asset class with long-term durability. Medical properties were very resilient through the downturn, have longer-term leases, substantial improvement build out, retention rates of 80-90%, and stable income growth and occupancy".

Property Transformation: Many hospitals in major metropolitan areas were built decades ago and their current functionality is obsolescent. In order to address today’s medical landscape, health systems are renovating existing hospitals to provide a patient-centric healthcare experience. For example, gone are the days where two patients have to share a room. Now, patients have large single-bedrooms loaded with technology, and are considered more accommodating for family visitation. In addition to constructing and renovating hospital buildings, healthcare systems are developing on or off-campus outpatient facilities. For example, ambulatory and urgent care centers are popping up in storefronts where now-defunct retailers used to be, like Blockbuster Video or Borders Books. These examples are considered the"retail-ization" of healthcare real estate.

So far, I've shared my background and gave you a quick primer on the tailwinds within the healthcare real estate industry. Now, let's examine the largest healthcare system real estate monetization in US history.

Overview: As reported by Healthcare Real Estate Insights (HREI):10 year, 92% leased (NNN), 52-building medical office portfolio. Purchase Price totaled $725 million ($225 psf), which includes an expected 24-month capital expenditures initiative priced at $32.9 million along with a portfolio sticker price of $692 million. According to Real Capital Analytics Inc, "this transaction marks the largest health system monetization of MOBs, and spans over 3.2 million square feet in 10 states." Approval from the Vatican was necessary due to the Roman Catholic Church's sponsorship of the health system.

Broker: Denver-based CBRE Healthcare Capital Markets Group (HCMG) is a part of the largest real estate service firm in the world, and specializes in providing healthcare real estate providers, developers, and investors with the acquisition, disposition, and debt & equity recapitalization strategies. According to CBRE's HCMG, "the portfolio consisted of thirteen medical office buildings (MOBs), four inpatient rehabilitation facilities (IRFs), and one multi-use campus with a surgery center and rehabilitation facility. In addition, the Portfolio includes nine multi-tenant properties with an opportunity for additional lease-up, as well as ten single-tenant properties with long-term leases providing more stability. These properties were in 10 different states that included Texas, Florida, North Carolina, South Carolina, New York, Pennsylvania, Ohio, Wisconsin, Missouri, and Kentucky. Virtually all major healthcare specialties are represented in the Portfolio."

Financial Advisor: Manhattan-based Hammond Hanlon Camp (H2C) is a leader in providing advisory services relative to monetizing, developing, and financing over $2 billion worth of healthcare real estate assets throughout the US, annually. According to H2C, the financial advisor, "CHI is one of the largest health systems in the country. In 2015, CHI generated approximately $15.2 billion in total operating revenues and had total assets of approximately $23.0 billion, and carries an investment-grade credit rating of A3/A-/ A+ by Moody’s, Standard & Poor’s and Fitch Ratings, respectively".

Seller: Colorado-based Catholic Health Initiatives (CHI) is the nation's third-largest nonprofit, faith-based health system. Typically, a healthcare system completes what's known as a sale-leaseback transaction because the cost to maintain their real estate assets is quite extensive. Furthermore, the capital infusion from sales proceeds is seen as a godsend for healthcare systems in desperate need of monetary funding. For CHI, the due diligence period took about five months of preparation before the portfolio came to market. An extensive examination of 65 non-core assets, which includes ambulatory care centers, administrative buildings, outpatient clinics, and excludes acute-care facilities. Several assumptions were tested asset by asset while structuring the portfolio.

Investor Selection Process: Twenty potential investors qualified to participate in the bidding process. Investors were given 30 days to underwrite the portfolio, and 4 investors made the short list. Typically, price is the key factor in negotiations for a seller, but there are many qualitative variables that come into play when considering a buyer for a sale-leaseback healthcare real estate transaction of this magnitude.

Buyer: Milwaukee-based Physicians Realty Trust (NYSE: DOC) is a healthcare real estate investment trust that acquires, owns and manages healthcare properties. Although, DOC was not the highest bidder, they were able to established a relationship with CHI in order to be selected as the buyer.

Last week at the 2017 BOMA Conference in Denver, DOC provided their Portfolio Assessment:

8 operating subsidiaries

6.2% unlevered cash yield on purchase price prior to committed CapEx

Contractual in place Cash NOI of $42.5 million

100% of buildings are on-campus or affiliated with a healthcare system

10 year NNN leases with 2.5% annual rent bumps

No debt was encumbered on the portfolio

Over night equity raise of $500 million

In conclusion, the age-old adage for real estate is "location, location, location", well in healthcare due to the operational risk associated with the property type the new adage is "operations, relations, and then location". As a result, this is more than just an investment where institutional investors insert their capital and wait to see what IRR poops out of the other end. This is comparable to marriage (with a 10-year prenuptial clause) as both the operational healthcare provider and the capital investor become one. As an individual that has taken a deep interest in the healthcare real estate industry. I hope and pray that this particular transaction encourages other healthcare systems and institutional investors to seek similar matrimony. Hopefully, I will be in a position to catch the garter belt at the next ceremony.